If you follow Internet news, you probably know that Internet browsers are phasing out (or not, as Google changed its decision lately) third-party cookies.

If you are in the Video Advertising business, this could be scary, as you may think that Connected TV (CTV) apps rely on cookies to target users. Fortunately, CTV adtech never depended on them.

Cookies are browser mechanisms (HTTP cookies) used on websites to track user behavior. Mostly, CTV apps run on smart TVs, streaming boxes, and consoles – not in web browsers – so there is no shared “cookie jar” on the device. Moreover, premium streaming services typically utilize server-side ad insertion (SSAI), such as those provided by broadpeak.io: ads are inserted into the video on a backend server, rather than being called from the client device. In practice, the viewer’s device never directly executes an ad call or has a chance to set up a browser cookie.

No browser + server-side ad stitching = no client-side cookies. In short, CTV is inherently cookieless by design.

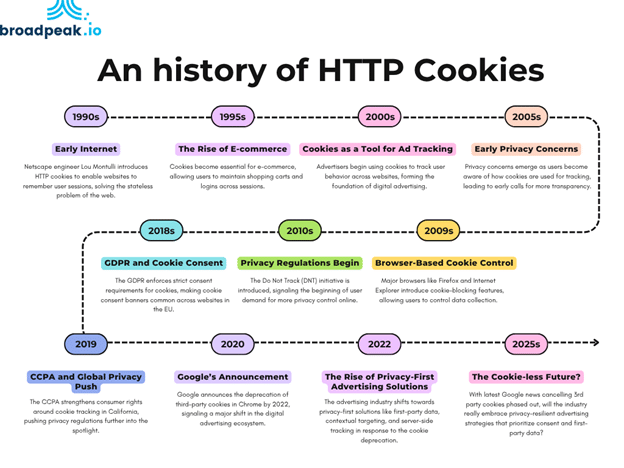

The history of HTTP Cookies

HTTP cookies have become a fundamental part of how we interact with the web, but their history is anything but simple:

- The Beginning (1994): Cookies were first introduced by Netscape engineer Lou Montulli to manage state on the web. HTTP, the protocol that powers the web, is stateless, meaning each request is independent of the last. Cookies solved this problem by allowing websites to store small pieces of data on users’ devices (like session identifiers), enabling features such as staying logged in or saving items in a shopping cart.

- The Rise of Ad Tech (2000s): By the early 2000s, cookies became a key tool for advertisers. They allowed companies to track user behavior across different websites, building detailed profiles for more personalized and targeted advertising. This helped fuel the boom in ad tech, as companies like DoubleClick (before its acquisition by Google) used cookies to serve relevant ads based on users’ browsing histories.

- The Privacy Backlash (2010s): As cookies became more widely used, so did privacy concerns. Users and privacy advocates raised alarms about how advertisers were using cookies to track online activity without consent. Browsers like Firefox started offering cookie-blocking features, giving users more control over their data. At the same time, the internet saw the emergence of privacy laws, such as the GDPR (2018) and CCPA (2020), which mandated user consent for cookie tracking.

- The Cookie Cracks (2020s): The significant shift came in 2020 when Google announced it would phase out third-party cookies in Chrome by 2022 (a move which was cancelled later). This was significant, as Chrome holds a dominant market share, and it indicated that the future of advertising and tracking would need to adapt to a cookie-less world. To replace cookies, Google introduced the Privacy Sandbox, which includes privacy-focused alternatives for ad targeting and tracking.

- The Cookie-less Future (2023 and Beyond): As cookies were planned to phase out, the advertising world started turning to first-party data and privacy-preserving alternatives like server-side tracking, contextual targeting, and unified identity solutions. Major browsers, such as Safari and Firefox, have already implemented stronger tracking prevention measures, making it clear that the future is respecting user privacy while still enabling effective advertising. Google’s 2024 announcement to cancel the phase-out of third-party cookies may impact the future of the advertising industry.

How CTV Targeting Works Without Cookies

You may wonder how CTV targets users without cookies. Well, CTV ad targeting relies on alternative signals – especially content, device attributes, and first-party data. These signals flow through the SSAI workflow.

Here you have a list of data that can be shared:

- Content and Context Signals:

- What’s playing on screen provides rich targeting cues. Metadata, such as genre, show title, content rating, or mood, enables contextual targeting without requiring personal identifiers. For example, an outdoor brand might target ads to adventure or nature documentaries, while a kids’ cereal might run ads during animated family shows.

- Contextual strategies have re-emerged as a cornerstone of CTV targeting because they align ads to relevant content and mood. In practice, campaigns are often planned by content category, time slot, or program theme rather than by individual user ID.

- However, the larger U.S. publishers are still hesitant to offer granular targeting and reporting based on specific content, primarily to maintain the “mass scale” of their ad campaigns.

- Device and Platform Attributes:

- Even without cookies, devices reveal useful info. Each ad request uses HTTP and can include device metadata (e.g., user-agent string, OS version, screen resolution) to help optimize delivery. Platforms or publishers often assign a pseudo-ID (an “Identifier for Advertising”) to devices or apps; these IDs, if available, can support frequency capping and basic segmentation.

- Ads can also be targeted by platform (e.g., Samsung TV vs. Roku) or by network (e.g., a news channel vs. a sports channel).

- Importantly, none of these uses third-party cookies – instead, CTV apps supply their own device IDs data in each SSAI ad request.

- That being said, IP targeting remains a common practice in many markets, particularly in the U.S. Although this method has its limitations and is often seen as less accurate for CTV than for traditional web ads. The limitations include IP rotation, where users’ IP addresses change frequently, making it difficult to track them consistently across sessions. Additionally, IP-based targeting lacks precision, as it often targets broad geographic areas rather than specific households, leading to less accurate audience segmentation.

- Authenticated First-Party and Session Data: Many streaming services require logins, giving them rich first-party profiles. These can be used for precise targeting and measurement. Beyond logins, platforms also leverage session-level behavior: how often a household watches, which time slots, and viewing duration. IP-address-based “household” segments are common on CTV; crucially, this is done without identifying a specific person. In summary, CTV enables deterministic (exact first-party) targeting when available, and probabilistic (behavioral/household-level) modeling for scale.

- Universal IDs and Data Partnerships:

- To bridge CTV with other channels, the industry is using privacy-friendly identity solutions. For example, Unified ID 2.0 (UID2), open sourced by The Trade Desk DSP,

- To bridge CTV with other channels, the industry is using privacy-friendly identity solutions. For example, Unified ID 2.0 (UID2), open sourced by The Trade Desk DSP,

- Additionally, advertisers and publishers are increasingly utilizing privacy-safe data “clean rooms” and identity graphs. In a clean room, a broadcaster can match its viewer data (first-party segments) with an advertiser’s data in a controlled environment.

- For added trust, publishers can also verify the compliance of clean rooms with the IAB’s Data Clean Room (DCR) guidance and recommended practices, as outlined in the IAB DCR Guidance.

CTV’s Privacy-First, High-Value Environment

Connected TV offers advertisers premium, brand-safe inventory on large, highly engaged screens. However, we’re still early in terms of fully adopting logged-in data for targeting.

This means that, for now, CTV ad targeting is still in its early stages of evolution. While video ads on CTV consistently achieve completion rates in the high 90s (around 96–98% on average), this doesn’t yet reflect the full potential of logged-in data, which could further improve targeting and measurement in the future.

It also found that CTV accounts for roughly 70% of all video ad views, dwarfing mobile’s share (~11%). This ‘lean-back’ viewing habit, where audiences are more relaxed and less likely to switch channels, means they are more attentive: nearly half of adults say they find TV advertising the most trustworthy medium (46% for TV ads vs. 19% for social ads).

In short, CTV’s combination of premium content and dedicated viewing translates to higher engagement and brand impact than many cookie-reliant channels.

Importantly, CTV’s cookieless model aligns with modern privacy standards. By design, CTV targeting focuses on relevance and consent, rather than invasive tracking. As one analysis puts it, privacy-first advertising on CTV does not compromise performance. In fact, by shifting away from “mass surveillance” and toward meaningful context and first-party data, many advertisers see stronger engagement and ROI, as quoted in this article.

Viewers in streaming environments watch big screens, often with fewer distractions, and when ads are relevant and respectfully delivered, they tend to respond positively.

Embracing CTV’s Native Targeting Logic

While it may be tempting to apply HTTP cookie strategies to CTV, it’s crucial to understand that CTV operates on its unique logic.

Here you have a couple of examples:

- Take the Trade Desk, for instance. In 2017, the company faced significant challenges when it attempted to apply its web-based programmatic model to CTV. However, by pivoting towards more context-driven targeting, it found success.

- Amazon encountered similar challenges in 2020 as it tried to use web and mobile data for Fire TV ads. However, the lack of cookie-based tracking in CTV necessitated a shift towards interest-based targeting and content-specific strategies, such as targeting ads to specific genres or shows, as explained in this article.

- Roku, one of the leading CTV platforms, initially attempted to use behavioral targeting based on web-like data but quickly recognized the limitations. This blog provides an excellent overview of their methodology.

- Even ViacomCBS faced similar growing pains, realizing that its web-based tracking methods weren’t suitable for CTV. Here is a great breakdown on how ViacomCBS currently connects advertisers and viewers.

These examples (very early in the CTV AdTech history) are just showing that advertisers are better leaning into what CTV does best: contextual and content-based relevance, household-level segmentation, and authenticated audiences.

Finally, it’s crucial to respect platform privacy features. Any CTV ad system must honor user choices (for example, “limit ad tracking” settings on a TV device). The IAB’s CTV guidelines emphasize that if a device or user has limited tracking, the ad flow should either omit identifiers or treat them as reset/disabled.

In this context, the IAB’s Transparency and Consent Framework (TCF) provides a standardized approach to consent management, ensuring that users have precise, granular control over their data collection and processing choices. By standardizing how consent is obtained and recorded, it improves trust and transparency for both users and advertisers. This helps advertisers comply with regulations such as GDPR and CCPA, while giving users more control over how their data is used, thereby enhancing the overall user experience and improving ad targeting accuracy.

Conclusion: CTV’s Cookieless Design is an Advantage

In a post-cookie era, Connected TV is not playing catch-up; it’s already there. The streaming industry has built its targeting ecosystem around content, consented data, and device-level signals, rather than relying on third-party cookies.

CTV’s cookieless design and reliance on IP targeting (and not always perfect identifiers, such as Universal IDs) have their drawbacks. However, the shift away from cookies toward privacy-first targeting remains a significant advantage. As the landscape evolves and logged-in data becomes more ubiquitous, the future of CTV advertising looks brighter, though for now, the lack of granular targeting means there’s still work to be done.

In conclusion, rather than viewing the cookie phase-out as a setback, advertisers should recognize CTV’s cookieless design as a feature. We acknowledge that cookies are becoming increasingly inadequate for reaching audiences across the diverse range of devices used in CTV (such as smart TVs, set-top boxes, and streaming platforms). This fragmentation demands more sophisticated, context-based advertising solutions that can effectively target users across multiple screens without relying on cookies.

By embracing contextual relevance, first-party identity, and newer cross-device IDs, marketers can reach audiences effectively on CTV – often with better results than legacy cookie-based tactics. In short, the disappearance of third-party cookies from the web highlights a truth CTV has known all along: powerful ad targeting can be achieved without compromising user privacy.