Within our industry, we thrive in offering additional and innovative viewing options to consumers. We also have a duty to follow viewers where they go watch video content, may that be on social media or on OTT platforms.

Today more than ever, viewers are changing the way they watch video content and one major victim of that is Broadcast TV.

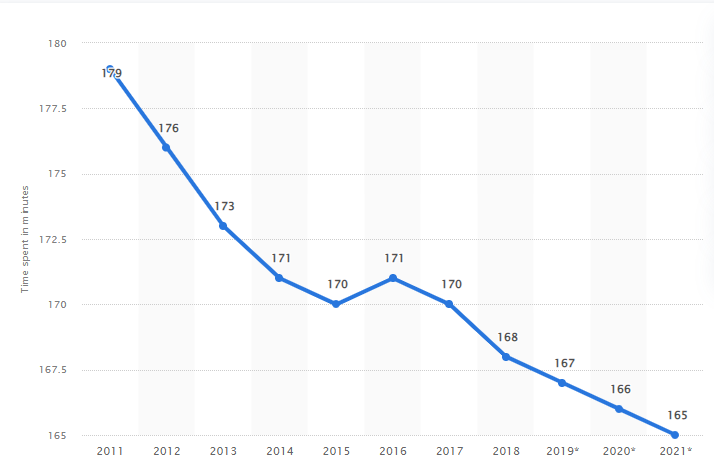

The trend varies from market to market, region to region, but there is no denying that our TV usage habits have changed drastically in the last ten years.

Let’s take the US for example.

Nielsen released 2022 viewership numbers (live + time shift) and it stings1. Only 37 networks out of 159 registered growth in their viewership numbers. If you look at the top 20 networks, only ESPN grew viewership by 13% year on year.+

On average, 34.89M prime time viewers tuned in (out of the 332M+ population).

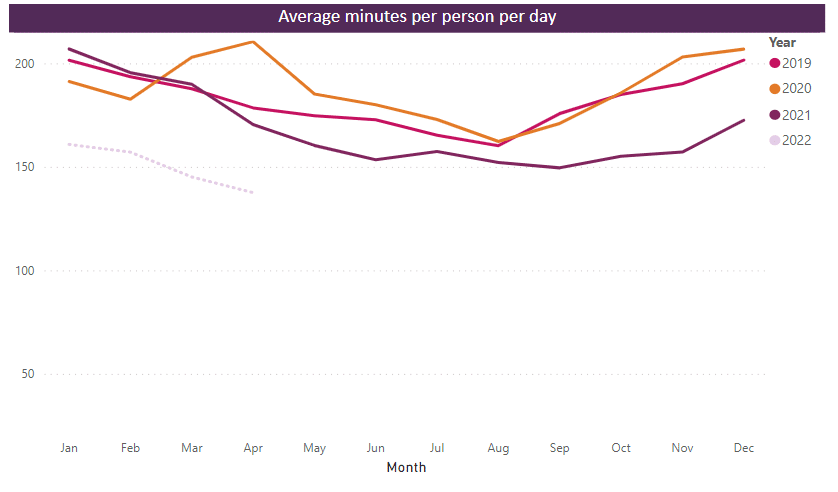

We observe a similar trend in the UK with OFCOM’s Media Nations 2022 Report 2. In the first half of 2022, UK individuals watched 2h24 of TV, way below the viewing time registered the 3 previous years.

What does it have to do with FAST?

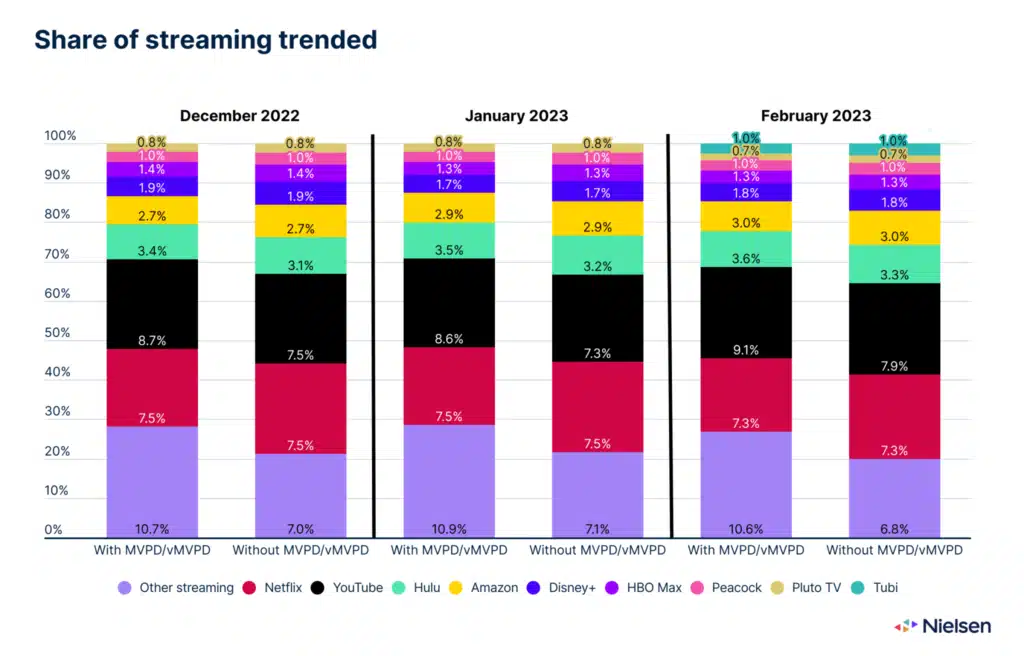

If consumers watch less traditional Broadcast TV, what and where do they watch video content? Social media, SVOD of course but more and more on FAST and AVOD platforms now too. In Nielsen’s February Gauge report3, Pluto TV and Tubi grabbed 1.7% viewership in February, ahead of HBO Max (1.3%) and right at the heels of Disney+ (1.8%). Peacock sits at 1% too (although we do not have a breakdown between SVOD, AVOD and FAST Channel consumption within Peacock). Additional FAST Platforms are in the “Others” bucket.

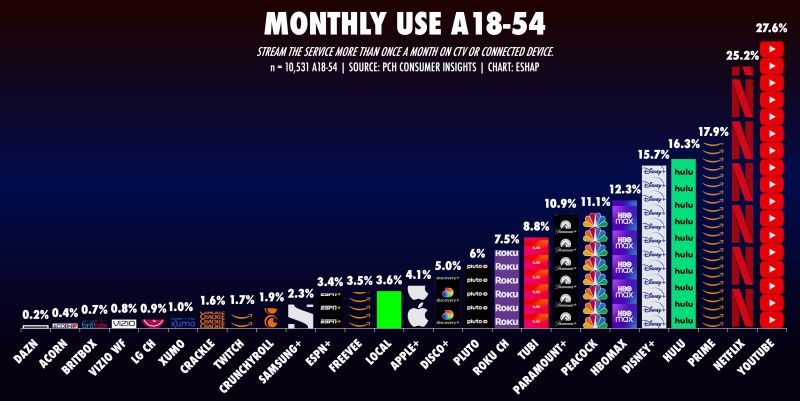

Evan Shapiro was kind enough to go more granular for us with a Publishers Clearing House Consumers Insights report4 on the monthly usage of streaming services amongst US adults. We have a suite of services with a FAST Channel component (The Roku Channel, Freevee, Samsung TV+, Vizio etc.) which contributes to additional FAST viewership.

How does FAST translate revenue wise?

Estimates are scarce when it comes to the FAST revenue potential. In 2022, estimates about the US market sit at 4B$ of revenues generated5. Today, FAST accounts for 2.5% of total global linear TV and video ad revenues6.

What will the revenues be by 2027?

Analysts all predict growth for the sector, but the estimates tend to vary:

- 6.1B$ by 2025 – Statista7

- $9 billion by 2026 – S&P Global8

- 12B$ by 2027 (10B$ US – 2B$ ROW) – Omdia9

- 33.7B$ by 2025, 42.6B$ by 2027 – TVRev10 but these numbers include both AVOD and FAST revenues unlike the abovementioned.

Looking at these numbers, two elements stand out:

- It’s hard to predict how much ad dollars will move to FAST, even more so outside of the US.

- It’s clear regions are not equal when it comes to the size of the FAST channel opportunity.

Why does the opportunity vary amongst regions?

The ingredients of the perfect storm taking place in the US are not a plug and play in other markets.

In the US what makes FAST compelling is:

- Costs – Free is an appealing value proposition since an average cable bill is around 116$11.

- Massive Pay TV losses – Pay TV and Cable Providers Lost 5.8M Subscribers in 202212.

- CTV penetration – 83% of US Homes are CTV enabled13.

- Advanced Ad Market – 18% of Video Ad Dollars already dedicated to CTV Advertising14.

- One Big Market – the reach of a single FAST Channel distributed across a 332M+ population.

By comparison, in Europe:

- Affordable TV & Broadband access – The French pay 40€ for triple-play packages.

- Resilient Pay TV – Western Europe lost 1.4M Pay TV subscribers in 2021, half of the US losses15.

- Linear TV – 200 minutes of daily viewing in 4 of EU5 markets16.

- Ad Market – 95% of Video Advertising Revenues go to Linear TV.

- Fragmented Market – Localization a must.

Should all Media & Entertainment companies invest in the space?

Every stakeholder in our ecosystem should conduct its FAST due diligence. You do not want to be on the outside looking in.

For content creators, FAST brings additional licensing or original content production opportunities. Some may even become a channel. Format producers like Banijay or Fremantle never went the Direct-to-Consumer route but now have a network of FAST Channels.

For streamers, it can either be a reach play, an acquisition tool or an engagement and retention play.

For Telecom Operators and Pay TV providers, it’s a natural extension of their aggregation business.

Now, this two-speed market (US vs ROW) should not discourage companies from entering the FAST arena.

It is still early days for FAST in most regions because who doesn’t like free content? One way or another your business will need to step a toe in the ad-supported business and FAST might be it.

In our next blog post, we will explore the Content and Platform FAST ecosystem as a new set of stakeholders have a tight grip of the space.

The FAST Blog Series – Part 3/5 to be posted soon!

1 Variety “Most watched television networks” – March 2023

2 https://www.ofcom.org.uk/research-and-data/tv-radio-and-on-demand/media-nations-reports/media-nations-2022

3 https://www.nielsen.com/insights/2023/with-less-high-demand-content-available-total-tv-usage-drops-in-february-streaming-stays-strong/

4 https://www.linkedin.com/posts/eshap-media-cartographer_on-demand-yesterday-in-response-to-nielsens-activity-7045022121613225984-eBPH?utm_source=share&utm_medium=member_desktop

5 https://www.spglobal.com/marketintelligence/en/news-insights/research/us-fast-revenues-could-near-4b-in-2022

6 Blue Ant – Omdia Report “Understanding FAST” : https://blueantmedia.com/2023/03/new-report-findings-show-fast-revenues-will-account-for-nearly-20-of-the-uks-3bn-premium-online-ad-supported-video-market-by-2027/

7 https://www.statista.com/statistics/1270462/revenue-free-ad-supported-streaming-tv-us/

8 Cf. N°5

9 Cf. N°6

10 https://www.tvrev.com/news/fasts-are-the-new-cable-part-2-advertising

11 https://www.doxo.com/insights/united-states-of-bill-pay-doxoinsights-cable–internet-report/

12 https://www.hollywoodreporter.com/business/business-news/cord-cutting-2022-cable-pay-subscriber-losses-1235340253/

13 https://www.iab.com/wp-content/uploads/2023/03/TVision-State-of-CTV-2H-2022.pdf

14 https://www.iab.com/wp-content/uploads/2022/05/2022-IAB-Video-Ad-Spend-Report.pdf

15 Digital TV Research

16 https://omdia.tech.informa.com/pr/2022-aug/linear-tv-viewing-down-as-online-long-form-viewing-time-increases-according-to-omdia