A new AI-based solution by Broadpeak and Media Press to unlock the long tail Addressable TV opportunities.

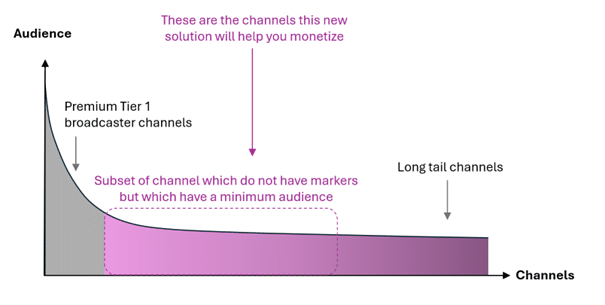

While the Ad Tech ecosystem is getting very advanced and sophisticated with programmatic and AI based capabilities such as clean room isolation, automated creative generation, real time inventory trading, etc…. a large portion of the Addressable TV opportunity remains untapped: the hundreds of linear TV channels which have no signaling cannot be monetized.

If we add up the cumulative audience of those channels, the opportunity becomes sizable. If most tier one Broadcasters have SCTE-35 markers in their live feeds, hundreds of TV channels are still being distributed without any cue points. While this lack of signaling is generally not a constraint for traditional broadcast, linear TV distribution and subscription models, it is a showstopper for ad-supported monetization models focusing on Addressable TV.

As pretty much all SSAI on the market rely on those markers in DASH or HLS manifests (see blog for more details), the lack thereof basically means that such streams cannot be monetized at all. This situation is not only problematic for the Broadcasters themselves, but it is also a lost opportunity for all their distributors such as Operators and Aggregators (ISPs, Telcos, Internet Service Providers, Cable Operators, mVPDs, …).

As shown below, in a typical channel lineup of hundreds of live Services, the subset in the long tail part can represent quite a missed opportunity in terms of cumulative audience.

Looking at the options on the table

If we step back and try to look at the available options, there are basically 3 main alternatives:

- Upgrading the source itself. This approach typically requires an update of the automation, scheduling, playout and encoding. This is the ultimate target to ensure the whole media preparation and content origination pipeline has frame accurate markers natively inserted during content origination stage.

- Leverage EPG metadata: there are two problems with track: it is usually inaccurate, and it lacks mid-roll ad-break information.

- Real time analysis of the live stream to identify ad breaks

In this paper, we are going to focus on option 3.

Powering real time live stream analysis with AI

Live stream analysis is making fast progress. By analyzing video, audio, subtitles, captions components and combining

- scene changes detection modules

- audio silence

- jingle and watermarks

- program schedule metadata

multi-modal AI models can now identify ad-breaks with high confidence.

The following snapshot shows timing corrections

The next question to ask at this stage is whether this is sufficient to complete an SSAI stack relying on SCTE-35 tags in DASH and HLS manifests. In other words, is automatic detection of frame accurate cue points enough?

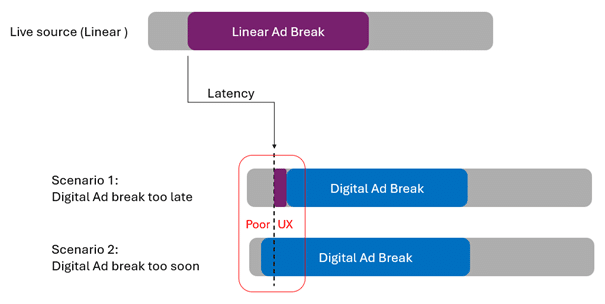

Let see at what happens with DASH and HLS streaming video typical chunked in video segments of few seconds (see link from background on streaming fundamentals).

With manifest manipulation, SSAI is by default going to do ad replacement at the video segment level. This implementation means that there is no reason to expect the cue point and the segment boundary to be aligned. If we look at the two opposite scenarios likely to happen, and as shown on the diagram below, we can see that digital ad break can either start too late or too soon.

With video segments of 6 seconds for instance, worst case scenario can be as much as 3 seconds ahead of time or 3 seconds after the ad break start. In the TV world, this kind of inaccuracy is way above any acceptable level. This variance typically leads to poor UX, lower engagement and therefore insufficient monetization levels.

The solution solving this problem is called dynamic stream conditioning and typically runs at the packager – origin level. This feature is basically allowing re-transcoding and re-packaging of the live video stream at the edges of the ad break. By splitting a video segment into two sub-segments, this implementation allows perfect alignment of video segments with cue point with frame accuracy.

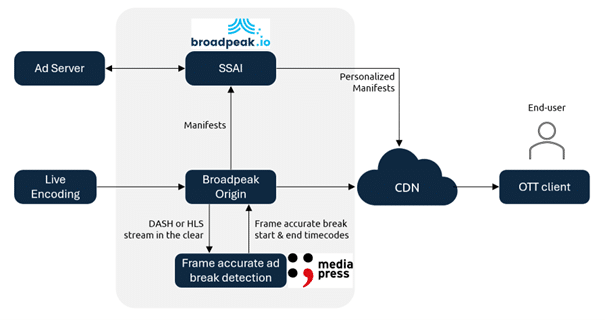

Now that we have automatic frame accurate ad-break detection with high confidence level, dynamic stream conditioning on the packager and SSAI of course, the solution is integrated in the following way.

How close to real time?

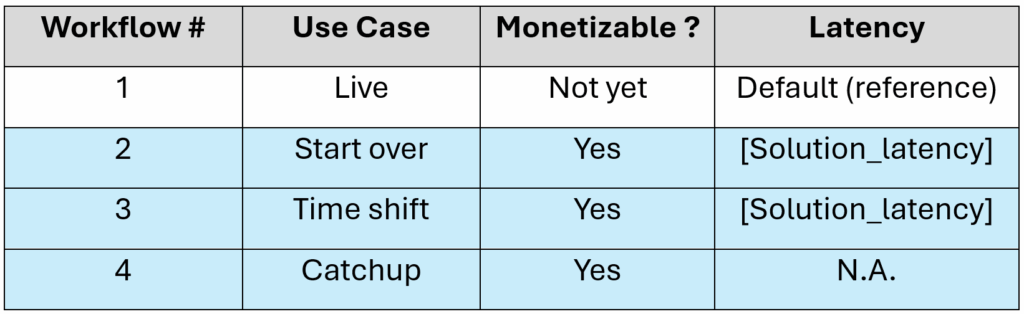

Real time live stream analysis falls into the heavy lifting category in terms of video processing. Although latency performances are improving on a regular basis, the starting point does not include live monetization at this stage. The good news is that several other workflows such as start over, time shift and catchup TV can already be monetized though.

Assuming analytics data is available, any streaming video service provider can actually make projections on the size of the opportunity based on volume of sessions being streamed every month for the different workflows. If we summarize the potential per workflow, we can list the options in the following way:

What’s next?

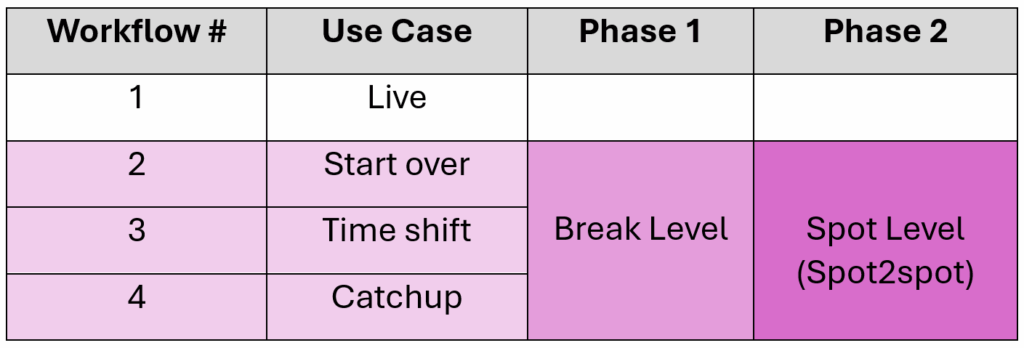

This joint Broadpeak-MediaPress solution is enabling Addressable TV monetization at the break level. This approach is a Phase 1 implementation intended to start the process and business model regardless of technical limitations affecting content provider feeds.

If we go one step further and optimize the solution further, we clearly see room for improvement with spot level ad replacement. In this case, the capability to replace ads goes down to the spot level which enables a way more optimized DAI workflow. Indeed, in this case, linear ads which are also relevant for digital audiences are left in and pass-through.

On the contrary, ads out of the targeted digital audience are replaced. As an example, in an ad break of 10 ads, only 1 ad needs to be replaced because the other 9 are valid for the audience, the spot level solution is saving 90% of your SSAI and Ad Serving costs. It is also putting way less pressure on Sales Houses to sell the inventory.

Want to see it running?

This new solution is unlocking a major challenge that does not have any easy nor off-the-shelf solution to date. It bootstraps your transition to ad revenue business model for the bulk of the channels which are not “monetization friendly”.

It helps both Broadcasters who are not ready with the signaling requirements of live DAI and their distributor to transition to a more profitable Addressable TV business model without sacrificing User Experience.

If you want to see this solution and the UX difference between various options, mark your calendar. Meet with the Broadpeak team at IBC 2025 | Hall 1 Booth #F.83 or with the MediaPress team at Hall 14 – Booth A.71

Book a meeting with Broadpeak (link to form) or Media Press (link).