Introduction for a winning ad strategy

In the digital age, where content is king and consumers hold the power to choose when, where, and how they consume media, the streaming industry is undergoing a remarkable transformation.

The accelerating pace of innovation, evolving consumer behaviors, and the global appetite for diverse content have all coalesced to redraw the media landscape. A new hybrid strategy is taking center stage that adapts to the current inflation, unlocks untapped revenue streams for content providers, and promises to reshape viewer experiences.

Welcome to the era of Advertising-Based Video-on-Demand (AVOD). Integrated with Subscription Video-on-Demand (SVOD) services a hybrid model rapidly gaining traction. As more content providers adopt this hybrid model, they find a balance that offers both consumer choice and monetization opportunities. This dynamic approach introduces the best of both worlds, delivering an expanded content library, reduced subscription costs, improved content discovery, and a diversified revenue model.

This article will dive into the unique characteristics of each model and analyze the integration benefits. We will not stop at theories and concepts, but rather, we will present real-world examples of successful hybrid SVOD+AVOD implementations.

What? SVOD VS AVOD – Definitions

SVOD – Subscription Video On Demand:

SVOD is a service that allows users to access a library of content in exchange for a regular subscription fee. The users can choose what they want to watch and when they want to watch it, making it an “on-demand” service.

Subscribers typically pay a monthly fee and can cancel their subscriptions anytime. There are no ads in the content, which is one of the key selling points for these services.

SVOD platforms generally invest in high-quality content, including original productions, to attract and retain subscribers. The business model relies on maintaining a large base of subscribers and continually adding new content to the platform.

The primary examples are Netflix (initially, we will return to that later), Sky on Demand, and LoveFilms.com

AVOD – Advertising-Based Video On Demand:

AVOD is a service that offers video content to users for free, but the service is monetized through advertisements. The users can watch the content without any upfront payment, but they must watch ads during the content, like traditional television broadcasts.

Examples of AVOD platforms include YouTube, Peacock (from NBCUniversal), Tubi, Viki and Viu. These platforms are free for users but generate revenue by selling ad space to advertisers. The ads are typically shown before (pre-roll), during (mid-roll), or after (post-roll) the video content.

AVOD platforms must balance their ad load to avoid frustrating users while generating sufficient ad revenue. The business model relies on attracting many users and serving targeted ads based on user demographics and viewing habits.

What about Mixing Them?

Imagine a platform where you could have some viewers access some content for free with ads (AVOD) and some paying a subscription fee for premium content or an ad-free experience (SVOD).

For instance, let’s create a hypothetical platform named “BroadpeakMax” (or “BroadpeakPlus” or “BroadpeakFlix” based if you prefer Blue or Red ?) that offers a vast library of films, series, documentaries, and more. BroadpeakMax operates on a hybrid model.

As a viewer, when you first sign up, you can use the service for free (AVOD model), where you can watch a range of content punctuated by advertisements. These ads generate revenue for the platform, enabling the service provider to offer the content for free. This is an appealing option if you don’t mind watching ads and are eager to save money.

On the other hand, if you prefer an ad-free experience, BroadpeakMax offers a premium subscription tier (SVOD model). You have access to the same library by paying a monthly fee but without any ad interruptions. This model is attractive if you value uninterrupted viewing and are willing to pay for it.

Further, there might be an additional tier where premium content or early access to new releases is exclusively available to subscribers. Another tier can be with a small fee and a bit of ads. This mix of free and premium content can cater to a diverse user base, allowing BroadpeakMax to reach a larger audience and potentially convert free users to paid subscribers.

Overall, this hybrid model provides a flexible, scalable approach for the service provider while allowing viewers to choose the mode of consumption that best fits their viewing preferences and budget.

Why? Examining The Benefits of SVOD + AVOD Implementations and Learning from Real-World Successful Examples.

The Rising Propularity of Hybrid Business Models

Changing viewer habits and expectations

For the last few years, subscription-based streaming services have braced for challenging economic conditions. Some research suggests that consumers are becoming more selective in their discretionary spending.

- A survey of Q3-2022 by Kantar indicated that over 11,435 U.S. video streaming customers, approximately 22.8% of subscribers to SVOD services that also offer AVOD tiers, such as Hulu, HBO Max, and Peacock, switched from SVOD to ad-supported options in Q3. This trend indicates that almost one in four subscribers are considering AVOD tiers for a price break.

- A 2022 Reviews.org survey found that approximately “two-thirds of respondents cited Netflix’s increasing cost as a reason for leaving.”

- A study from DeepIntent and LG Ads Solutions found that 64% of CTV watchers would rather see ads than pay more for a subscription service.

- AVOD services will gain more than triple the U.S. viewers that subscription OTT video will in 2023 per an eMarketer forecast. AVOD will add 13.3 million viewers for a total of 157.1 million. Meanwhile, SVOD OTT services will gain 4.3 million viewers to reach 222.2 million.

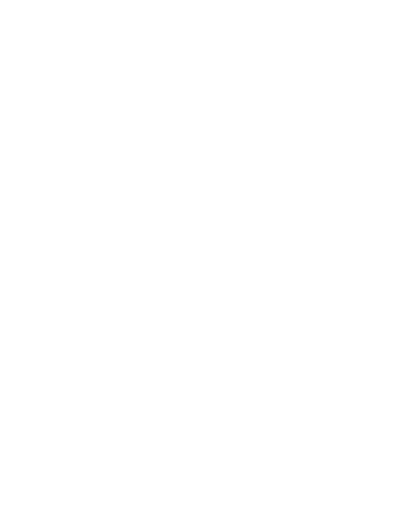

Consumers seek discounts amid rising content prices and other inflationary pressures. And the phenomenon is global, as noticed by Deloitte:

Benefits of An SVOD + AVOD Approach

In that context, incorporating an AVOD model into an existing SVOD service is a defensive move to keep existing customers. But it also has the potential to substantially augment revenue streams and better leverage the service’s content catalog.

Consequently, implementing a hybrid AVOD + SVOD model is a robust strategy to address audience fragmentation and mitigate the risk of churn, allowing providers to adapt monetization levels based on catalog specifics and content distribution rights.

Moreover, the growth relay offered by AVOD is not to be underestimated. Comscore’s 2022 State of Streaming report indicates that AVOD services saw a faster adoption rate, experiencing a 29% increase in

U.S. households compared to SVOD’s 21% during 2022. This suggests the prospect of an additional, rapidly expanding stream of revenue.

Importantly, this hybrid model helps service providers sidestep an over-reliance on subscriber revenue — a pitfall identified by the Harvard Business Review — that often leads to the downfall of subscription services.

With possibilities for upfront payment, as illustrated by HBO Max’s innovative AVOD upfront ad deals, this hybrid model could further diversify income avenues.

Furthermore, introducing AVOD into an SVOD framework assists in combating subscription fatigue, a growing issue in today’s saturated digital content marketplace. By providing audiences with flexible viewing options, services can foster consumer loyalty, bolstering their long-term market position.

A hybrid AVOD SVOD model promises a potential revenue increase and a sustainable path toward a more diversified, flexible, and customer-friendly service. The ad tier helps bring more subs to the subscription tier by being a gateway for customers who otherwise would not have been interested in the service.

Examples of Winning Strategy for Content Providers

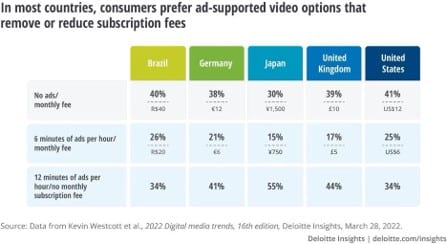

Netflix

Netflix’s ad-supported tier, launched in early 2023, experienced substantial growth, with its subscriber base nearly doubling in Q2 2023. Netflix gained 5.9 million new paid subscribers in the same period and has eliminated the lowest-cost ad-supported option to encourage uptake of the higher tier.

This is supposed to represent an estimated 15 billion impressions annually at a CPM of around $55. The ad-supported tier produced higher average revenue per user (ARPU) than the standard ad-free plan. Netflix is targeting to have advertising revenue constitute 10% of total revenue.

”We are pleased with the current performance and trajectory of our per-member advertising economics. In the U.S., for instance, our ads plan already has a total ARM (subscription + ads) greater than our standard plan.”

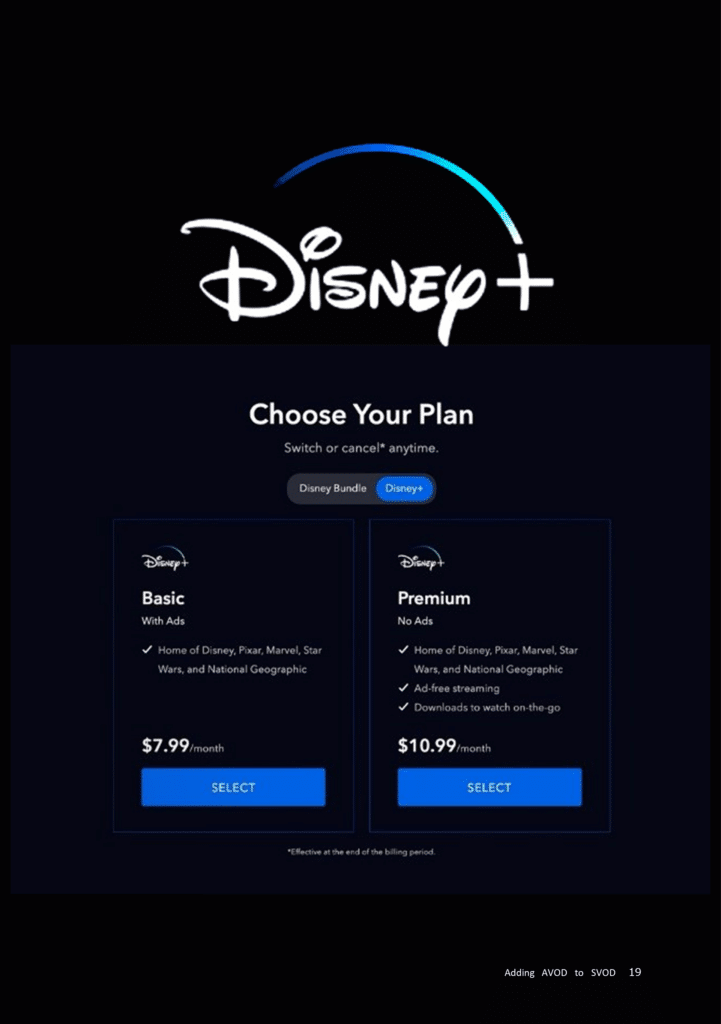

Disney+

Disney+ Basic, an ad-supported subscription service, is now available in the U.S. and launched with over 100 advertisers. The basic plan offers the same content catalog and key product features as the Disney+ premium plan, including exclusive content, up to seven profiles per account, simultaneous streaming on four devices, and high-quality video formats. The basic plan costs $7.99 per month, offering a cheaper alternative to the $10.99 per month premium subscription. The service has attracted significant advertising partners across various industries.

Disney’s ad-supported subscription plan outperformed both Netflix and HBO Max regarding new subscriber acquisitions in the U.S., as per Antenna’s co-founder and CEO Jonathan Carson.

The launch of an ad tier by Disney+ coincided with a price increase, resulting in 5% cancellation and less than 1% of existing subscribers switching to the ad-supported plan.

“The truth is, we have only just begun to scratch the surface of what we can do with advertising on Disney Plus, and I’m incredibly bullish on our longer-term advertising positioning,” said Disney CEO Bob Iger.

Partner

Partner, an operator in Israel, has long advocated for the importance of advertisements. They successfully added an AVOD system to their TVOD business a couple of years back leveraging Broadpeak’s technology. AVOD is a great gateway to increase subscribers and convert them into TVOD for additional revenues.

Curiosity Stream

CuriosityStream, a documentary and factual-based subscription streaming service, is leveraging ad-supported content to achieve positive cash flow by Q1 2023. The company has grown its revenue and subscriber base significantly since going public in 2020, with 24 million paid subscribers as of March end.

The CEO, Clint Stinchcomb, outlined a strategy focusing on ad-supported content to increase viewer engagement and monetize advertising and sponsorships.

The launch of their ad-supported streaming TV channel, Now Free, in partnership with LG, marked the company’s first venture into free streaming. As CuriosityStream builds its revenue through ad-supported services and enhances its SVOD promotions, the company anticipates continued growth in profits and revenues.

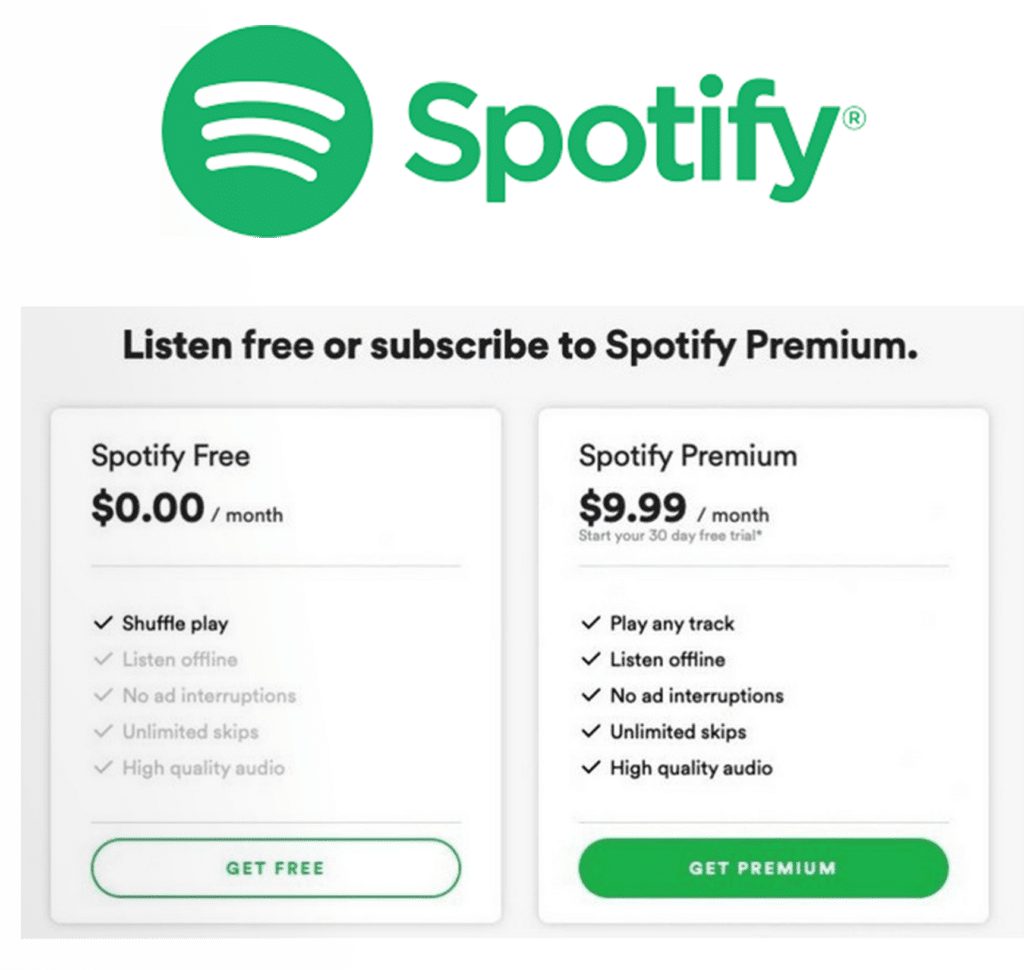

Spotify

Spotify is an excellent example of a business that has carefully included advertising and subscriber revenue streams, even though it is not a video platform (hence, it cannot be said to use an AVOD or SVOD model). The Hollywood Reporter reported in a January 2023 story that Spotify had “489 million monthly active users (MAUs) at the end of December 2022, up from 456 million at the end of September.”

According to the publication, advertising revenue “continued to grow despite slowing ad momentum at some digital giants amid fears of a recession” in the fourth quarter of last year. In particular, the company’s “quarterly ad-supported revenue rose 14% year-over-year.”

Based on that success, Spotify started focusing on video advertising, aiming to leverage its primarily audio-based platform to provide additive value to users’ listening experiences. Recognizing that users often have their sound on when using Spotify, the platform presents a unique opportunity for advertisers to reach audiences through video ads. However, Spotify ensures these ads only appear when a listener’s screen is viewable. Furthermore, Spotify recently launched a video-centric home feed, similar to TikTok, promoting the discovery of new music, podcasts, and audiobooks through autoplay preview clips to enhance user engagement.

More and more to come

There are more examples of hybrid services announced daily; here are a few of them that will be interesting to follow:

Comcast’s Sky Deutschland has launched an ad- supported version of its streaming service, Wow, with the Wow Basic tier costing €8 a month and offering a selection of TV series. Additional tiers include a €10 a month plan for succession and movies and a sports- inclusive plan at €30 a month. The ad-free version, Wow Premium, remains at €13 a month. Discounted rates are available for six-month commitments.

BET is launching a lower-priced ad-supported tier called “BET+ Essential” for its BET+ streaming service at $5.99 a month, offering the same content as the ad-free version but with ads. Introducing this tier aims to expand BET’s reach, and despite expecting some users to shift to the lower-cost tier, BET predicts an overall increase in subscribers.

The Czech broadcaster TV Nova is developing a new version of its AVOD service nova.cz through HbbTV, with plans to launch a pilot for addressable TV by the end of 2024. TV Nova aims to balance SVOD and linear content, anticipating market consolidation that would leave room for up to three profitable local and global services in the Czech Republic.

Why not you?

In this volatile economy, growth demands reinvention. If you are offering an SVOD service, it’s time to shake things up and add an AVOD tier, following Netflix and Disney’s successful examples.

Integrating AVOD into your platform is about more than just broadening revenue streams and catering to the cost-conscious consumer.

Ads aren’t the enemy; they’re your ticket to understanding viewer behavior, maximizing personalization, and securing a more profitable future!

When you play safe, you risk enabling competitors to take a bold, hybrid approach. You can embrace change, too, and tap into uncharted potential by following our guide.