If you could not attend the Future of TV Advertising Global 2023 in London this year, you may be wondering what have you missed, aren’t you? key statements, what was presented during this not-to-be-missed two-day conference and so on.

To help you save time, I decided to summarize the important points for you. Instead of going through each post, comment, or recording individually, I have gathered the key highlights in this blog to make your life easier!

With everything neatly summarized, you won’t have the fear of being left out. Consider this your VIP pass to never miss a beat. Let’s start!

Starting with the analyst findings

As in most tech-based industries, the advertising market is a fast-moving space. Otherwise, keeping current on trends is critical for anyone doing business in the $60 billion TV market. Richard Broughton, Executive Director from Ampere, shared some insightful numbers and trends on the growth of ad-supported streaming (see presentation). If you were to keep the essential, we would retain the following five takeaways:

- Ad-supported tiers help bring in customers when their budget is tight.

- Re-subscription is significantly higher for ad-tier plans.

- Compared to the US, BVOD accounts for quite a significant ratio, in Europe, in terms of monthly usage of streaming services

- Free ad-supported products (as FAST channels) are now the fastest-growing segment of the streaming market.

- Over the next five years, the long-form ad-supported streaming market will be worth >$40bn

Comcast Advertising: a new definition for premium video

James Rooke, President of Comcast Advertising, was one of the first speakers on stage, sharing his views with the audience. Although the whole session was insightful, there is one quote that I found very helpful to keep in mind when defining premium video. Each word in this statement translates to heavy-weight requirements when considering the ecosystem stack required to deliver superior video to viewers. “Premium video is content delivered transparently, in a trusted brand-safe environment, seen by real people within a high-quality viewing experience”.

ITV: focus on business!

Kate Waters, Director of Client Strategy and Planning, effectively conveyed a simple but often left-aside message. Leveraging one of the most famous quotes from Harvard Business School Professor Theodore Levitt (“People don’t want to buy a quarter-inch drill. They want a quarter-inch hole!”), Mrs. Waters outlined the fact that most players in the industry are still very much focused on the outputs (measurements, impressions, …) while the real desire and goal are pretty much at the other end of the value chain spectrum. Everyone is looking for something more concrete and business-oriented: what is the business outcome of ad campaigns, and how do those ad campaign dollars translate into incremental sales growth?

Besides this outline on the crossroads between marketing and business fundamentals, Mrs. Kate also reminded attendees of ITV’s latest progress in ad tech business services. The recent PR “ITV Launches New Measurement Innovation Tools: Addressable Lift and TV Auction Boost” clearly highlights some of the work done by ITV in this space. Full-funnel measurement and paid search activity (together with Omnicom Media Group and Percept) are the first two outcomes of this effort.

YouTube

Let’s make it clear: YouTube wants to become a ubiquitous distributor. Not just for short or very short-form content (catching up on TikTok and Instagram’s Reels). But also for live news and, more generally, premium content from TV broadcasters and sports streamers.

YouTube is open to working with everyone; this is not just a vague intention. This strategy started to be put in motion several years ago on a scale through commercial agreements and with tier-one content providers. In case you missed it, the deals signed with DAZN and Channel 4 are a good illustration of this move:

- DAZN And YouTube Enter Groundbreaking Partnership To Bring UEFA Women’s Champions League To Fans Around The World, Live And For Free

- Channel 4 and YouTube strike pioneering content and commercial partnership | Channel 4

For instance, from an audience access standpoint, YouTube benefits from an impressive 90% reach in the UK. If we narrow down the audience to a younger generation, YouTube is used by 98% of online 18-34-year-olds each month. In other words, YouTube alone is becoming a go-to platform for certain advertisers, with a guaranteed reach.

No one answered the sensitive question about whether YouTube (and other streamers) should, at some point, join BARB (Broadcasters’ Audience Research Board) or whether its ad creatives should be checked by bodies such as Clearcast.

Sky Liberty advisors: “Broadcasters, don’t give up too soon!”

Ian Whittaker, Managing Director and Owner at Liberty Sky Advisors, shared his viewpoint leveraging historical analogies.

To put it in simple terms, social networks (TikTok, YouTube, and the like) are trying to “steal” linear advertising dollars. Even if partnerships are possible (as highlighted above), everyone is, at some point, fighting for the same ad campaign bucket.

The truth is that TV has much of what is needed to succeed. Even if linear still must transform, for instance, with addressable leveraging digital distribution, TV also has what advertisers seek: content, brand safe environment, and mass audiences. Broadcasters’ objective should be to reconquer lost audiences, and Gen Z has yet to be part of the audience. Why not use social networks’ recipes with short-form content without going into the UGC? Why not put together a linear channel with DIY episodes?

Inspired by Winston Churchill, the saying “Defeat is not inevitable, victory is possible” may not suffice alone.

Roku: welcome to Roku city

This session was one of my favorite ones! Not watching anything is an advertising opportunity, for instance, with Barbie showing up on your TV.

While the original Roku City screen was a simple screensaver back in 2017, Roku has turned this homepage into an innovative and powerful brand advertiser space. Roku has more than 70 million active global monthly accounts, so this exclusive publishing environment is becoming very attractive for advertisers. Partnerships with Paramount, Barbie, Mcdonald’s, or Lego are a few examples of brands willing to spend a premium ad campaign budget to be visible in town.

In parallel, Roku is now very active on interactive ads with click-to-text (SMS), click-to-email, click-to-cart, etc – and scanned QR codes. The work done with System1 for CTV ads and showcased during the conference was a good illustration of the capabilities being prepared. Altogether, Roku seems well engaged in performance advertising and is putting self-selling in its strategy on the not-so-long-term horizon.

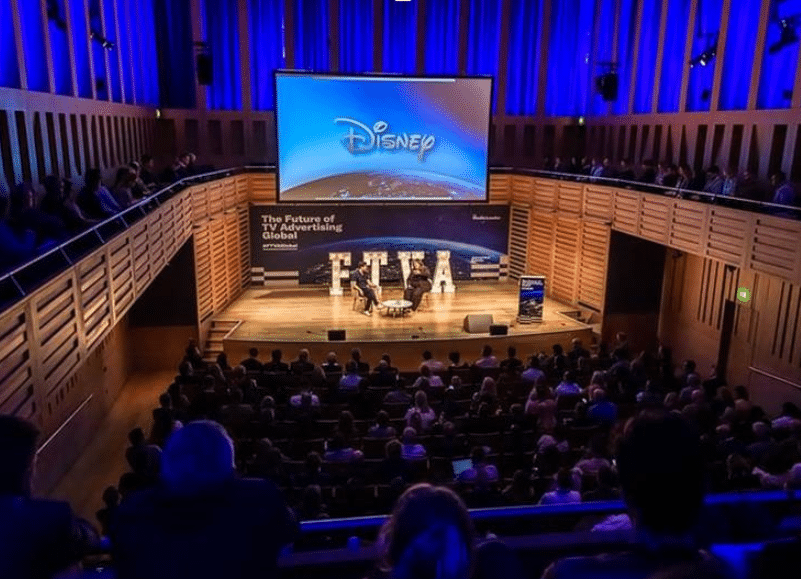

Disney: a “fence-guarded” platform

Disney was one of the most insightful sessions with illustrative milestones and numbers. Almost a year after the launch of ad-supported tiers on Disney +, one must admit that having one out of two new subscribers choose an ad plan when subscribing to the streaming platform is an impressive success. From the outside, Rita Ferro, President of Disney Advertising, has executed a win-win strategy, meeting market shifts with a new positioning (dealing with brands and agencies) and product and business requirements. Disney is leveraging years of experience and monetization strategy with Hulu and an advanced ad tech stack, using more than 140 clean rooms for private transactions.

With whom Broadpeak partnered for SSAI and DAI Ad Pod Serving (See Blog), Google highlighted addressable‘s pros, cons, challenges, and business benefits, including HbbTV.

Robert Curwen, Head of Advanced TV, Go to Market Partnerships EMEA at Google, also made some valid points on brand safety and viewer protection with IAB TCF (Transparency Consent Framework), Clearcast in the UK, and ARPP in France, for instance.

What Content Providers do not want?

This question, asked during the Sky/ITV/Channel 4 panel, was interesting.

It is helpful to understand better the challenges broadcasters face in this rapidly changing landscape. From the 10000-foot view, publishers’ inventory may seem comparable, but let’s be fair: a 2-second scroll ad on display cannot be compared, apple to apple, with a 30-second video ad on TV.

And this is more than just a matter of reach and finding the right audience at the right time. TV has a unique value proposition even if platforms have been doing a great job with extensive data, scale, and “easy to buy” inventory. TV brings attention (longer form ads), trust, and a brand safety environment. This value proposition has yet to be equivalent on most platforms and social networks to date.

WFA: leading the forefront of CMM (Cross Media Measurement)

Besides all the challenges highlighted during the conference, the World Federation of Advertisers decided to tackle one of the most problematic pain points in the industry: cross-media measurement. As advertisers need to understand the efficiency of their ad budget in a very fragmented distribution environment, the ability to make measurements with consistency, accurately, continuously, at scale, with a full-funnel approach, in a fair way, with objective metrics and respecting end users’ privacy, is suddenly becoming paramount. That’s how the definition of an advertiser-centric ‘North Star’ set of requirements was implemented.

From that reference point, which was an advertiser-led effort, the WFA came up with a cross-media measurement framework called Halo, which the consortium has been heavily working on and advocating. Halo was presented by Rishi Saxena, Global Ad Effectiveness Research, Data, Signals, and Measurement Product Leader.

Behind the scenes, a global engineering team has put significant work into ensuring the Halo framework meets concrete requirements. The idea was to avoid any black box and establish confidence throughout the entire process. A GitHub page provides open-source code that is freely and transparently accessible.

As the first concrete example, ANA in the US and ISBA (with the Origin project) have started implementing this technology in advanced projects.

Overall, the Future of TV Advertising conference was a great place to feel market trends for 2024 and beyond, understand how the crossroads of advertising, television, content, and streaming industries interact, and network, of course! Well done to all presenters and panel moderators, and special mention to Justin Lebbon for his fine sense of humor!

Conclusion

In conclusion, the Future of TV Advertising Global 2023 conference provided valuable insights into industry trends and opportunities. Topics covered included ad-supported streaming, the definition of premium video, business outcomes, platforms like YouTube and Roku, ad-supported tiers on Disney+, and cross-media measurement challenges. This event was a valuable resource for staying informed and connected in the TV advertising world. Even if you missed it, you now have the essential takeaways from the conference.